Ramp, a corporate credit card and expense management startup, is harnessing the power of artificial intelligence to provide a suite of customer services, including contract analysis, expense auditing, and customer query responses. By leveraging OpenAI's GPT-4 technology, Ramp is setting a new trend in the fintech industry, offering a unique blend of automation, customer service, and cost-saving measures.

The Emergence of AI in Fintech: Ramp's Innovative Approach

In the bustling world of technology and startups, artificial intelligence (AI) has become a beacon of innovation. Among the companies making waves in this space is Ramp, a corporate credit card and expense management startup. Ramp has recently launched a suite of services that utilize the advanced capabilities of OpenAI's GPT-4 technology. This move places Ramp at the forefront of a growing trend of fintech firms integrating AI for enhanced customer service and automation.

The corporate financial landscape is currently witnessing an evolution spearheaded by Ramp. This fintech giant, founded in 2019, is shifting paradigms with its new generation of finance tools that are actively reducing costs and exponentially increasing efficiency for businesses across America.

Ramp's Innovation: A Snapshot

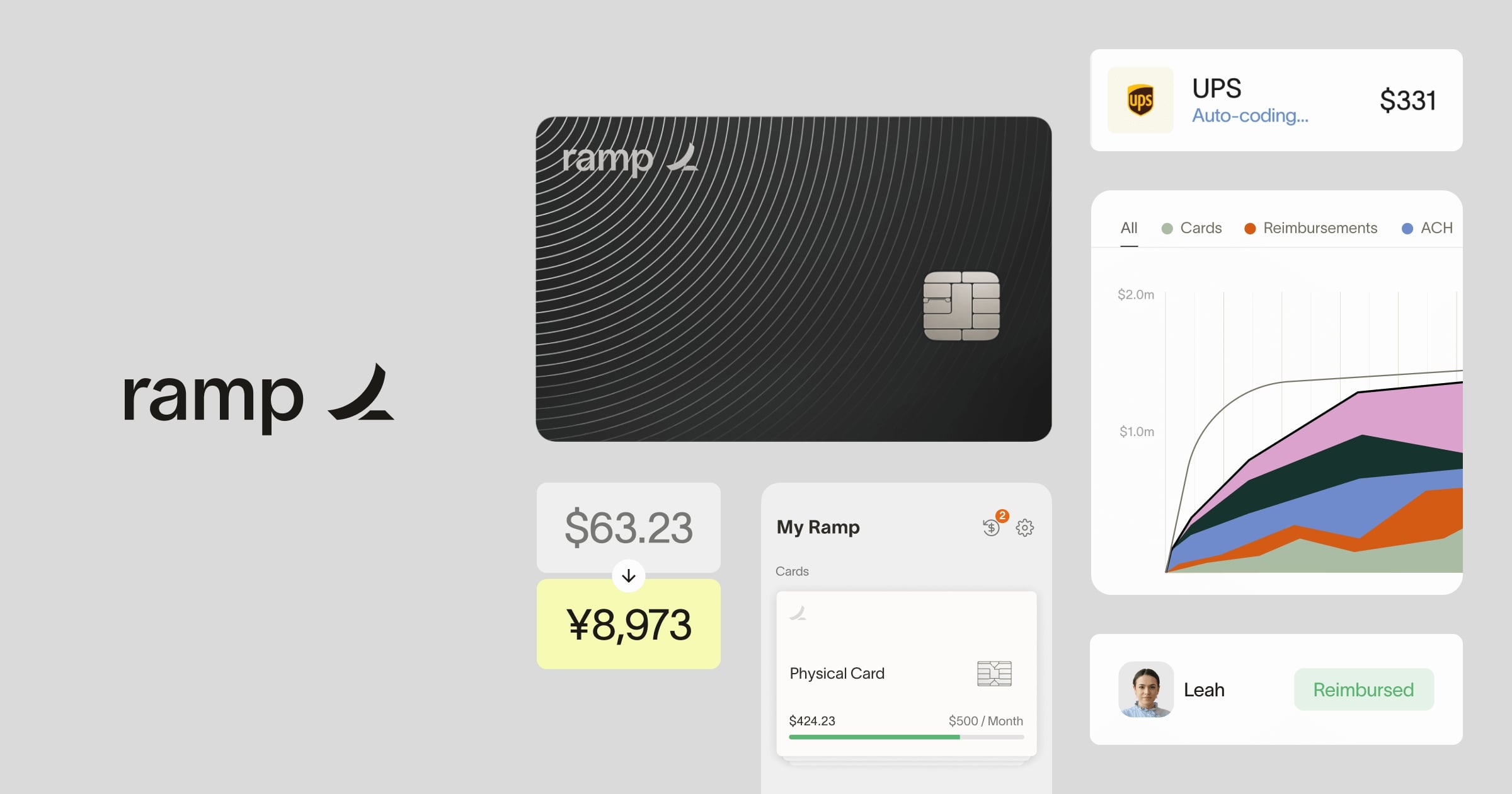

Ramp has successfully established a broad-ranging financial automation platform, comprising corporate cards, expense management, bill payments, and accounting integrations. These tools have been designed with the express goal of conserving businesses' precious resources: time and money. The numbers testify to Ramp's effectiveness, with more than 15,000 companies experiencing an average savings of 3.5% and achieving an 8x faster book-closing rate after adopting Ramp's solutions.

Ramp's corporate card, touted as America's fastest-growing, facilitates billions of dollars of purchases annually. This remarkable uptake is a reflection of a nearly 10x year-over-year growth, a commendable achievement that underscores the market's trust and confidence in Ramp's offerings.

A Diverse Customer Base and High Market Recognition

One of the defining characteristics of Ramp's success is its diverse customer base. From software unicorns to complex farming operations, from startups to non-profits, Ramp's platform serves a vast array of businesses. Notable clients include Morning Brew, 818 Tequila, KIPP Public Schools, Webflow, and large-scale businesses like Anduril and Avelo Airlines. This cross-sector trust in Ramp's services indicates the adaptability and versatility of their financial tools.

Ramp's innovative drive and resultant success have been recognized by Fast Company, which named the startup as the Most Innovative Company in North America in 2023. This is a clear testament to the firm's sustained ability to deliver groundbreaking solutions in the finance sector.

Impressive Valuation and Notable Investors

Ramp’s performance and promise have not gone unnoticed in the investment community. Currently valued at an impressive $8.1 billion, Ramp is the fastest-growing startup in New York City. This valuation reflects the market's confidence in Ramp's business model, growth trajectory, and the impact of its innovative solutions.

Its investor list reads like a who's who of investment giants, featuring names such as Founders Fund, D1 Capital Partners, Thrive Capital, Stripe, and General Catalyst. The financial backing from these reputable firms further amplifies the credibility of Ramp’s services and its capacity to transform the financial automation sector.

AI-Powered Contract Analysis: A Game-Changer in Vendor Pricing

Ramp's CEO, Eric Glyman, highlights the challenges many businesses face when trying to secure the best price from software-as-a-service (SaaS) vendors. With the introduction of Ramp's AI-powered contract analysis tool, businesses can now upload vendor contracts for automatic extraction of key details such as pricing and software seats. The service then compares the pricing against anonymized data from the nearly $1 billion spent on Ramp each month by some 15,000 companies. This comparison is presented in a graph, indicating whether the quoted price is a good deal compared to market averages. If the deal isn't favorable, Ramp can negotiate prices using their data as leverage.

The Power of GPT-4: Understanding the Fine Print

The success of this service is largely attributed to the capabilities of GPT-4, which has been trained to understand and interpret large amounts of text. This allows Ramp Intelligence to scan through a contract's fine print and understand the context, a task that older AI technologies struggled with due to the unstructured nature of the text. While some companies are already using AI to help lawyers analyze contracts, Ramp is the first to bring large-scale pricing data to consumers.

High-Profile Investors and Advisors: A Vote of Confidence

Ramp's innovative approach has attracted the attention of high-profile investors and advisors. Microsoft CEO Satya Nadella, who led Microsoft's $10 billion investment in OpenAI, has joined Ramp as an investor and advisor. Other notable figures include Quora CEO Adam D'Angelo, Instacart chief Fidji Simo, and Stanford AI Lab professor Chris Ré. Their involvement underscores the potential of Ramp's AI-driven approach.

Expanding AI Offerings: Chatbot and Email Integration

Ramp's AI offerings are not limited to contract analysis. The company has also launched a chatbot that provides cost-cutting advice and an integration with Gmail and Microsoft Outlook that automatically identifies and scans email receipts to process expenses in real time. These tools further demonstrate Ramp's commitment to leveraging AI for improved customer service and cost efficiency.

The AI Wave in Fintech: Ramp Leading the Charge

Ramp's AI launch is part of a broader trend of fintech startups embracing AI. Companies like Stripe and Navan have also launched tools using GPT-4, while others like Upstart and Sentilink have been using AI since their inception. Ramp, valued at $8.1 billion last March, has also been using AI since its launch, analyzing transaction data to flag wasteful spending. With its latest batch of tools, Ramp is poised to increase its potential savings for customers, solidifying its position as a leader in the AI-driven fintech space.

The Future of Ramp: A Look Ahead

While Ramp has already made significant strides in the fintech industry, the future holds even more promise. With the continued integration of AI and the support of high-profile investors, Ramp is well-positioned to continue its growth trajectory. The company's commitment to innovation and customer service, coupled with its ability to leverage large-scale pricing data, sets it apart in a competitive market.

Ramp's success story serves as a testament to the transformative power of AI in the fintech industry. As more companies follow suit, the landscape of financial technology is set to change dramatically, with AI-powered services becoming the norm rather than the exception.

Ramp's innovative approach to expense management and contract analysis is not just about cutting costs—it's about empowering businesses with the tools they need to make informed decisions. And with AI at the helm, the possibilities are endless.

The Expansive Scope of AI in Fintech: A World of Possibilities

Artificial Intelligence (AI) has been a game-changer in the financial technology (fintech) industry, opening up a world of possibilities and transforming the way businesses operate. Despite the significant strides made in this field, competition remains relatively modest, leaving ample room for innovation and growth.

AI in Risk Assessment and Fraud Detection

One of the most prominent applications of AI in fintech is in risk assessment and fraud detection. AI algorithms can analyze vast amounts of data in real time to identify patterns and anomalies. For instance, AI can detect unusual transactions that deviate from a user's typical spending behavior, helping to prevent fraudulent activities. Companies like Sentilink are already leveraging AI to catch identity fraud, a testament to the potential of AI in enhancing security in the fintech industry.

AI in Personalized Financial Services

AI also plays a crucial role in providing personalized financial services. Robo-advisors, powered by AI, are capable of providing personalized investment advice based on an individual's financial goals and risk tolerance. Companies like Betterment and Wealthfront have made significant strides in this area, offering AI-driven investment management services that are tailored to the needs of individual investors.

AI in Customer Service

AI-powered chatbots are revolutionizing customer service in the fintech industry. These chatbots can handle a wide range of customer queries, providing instant responses and improving customer experience. For instance, Navan's customer service chatbot, Ava, uses OpenAI to field queries from travellers and company finance teams, showcasing the potential of AI in enhancing customer service.

AI in Contract Analysis and Pricing

AI is also making waves in contract analysis and pricing, as demonstrated by Ramp's innovative approach. By leveraging AI, companies can automatically extract key details from vendor contracts and compare pricing against market averages. This not only ensures businesses get the best deal but also saves them the time and effort involved in manual contract analysis.

The Future of AI in Fintech

While AI has already made significant inroads in the fintech industry, there is still a vast untapped potential. For instance, AI could be used to predict market trends, enabling businesses to make informed investment decisions. AI could also be used to automate tax preparation, saving businesses time and reducing the risk of errors.

The scope of AI in fintech is expansive and continues to grow. As more companies recognize the potential of AI and embrace this technology, the fintech industry is set to witness a wave of innovation and transformation. The modest competition in this space presents a unique opportunity for businesses to leverage AI and gain a competitive edge. Let's see what the future brings!